Mutual Fund

Mutual Funds can best serve as an investment tool. So whether you are planning for your house, child's education or marriage, your car or vacations, Mutual fund is a simple, tax efficient and effective tool to invest for these goals. Besides, Mutual funds offer a wide bouquet of investment options - equity schemes, fixed income schemes, money market schemes, hybrid schemes, ETFs etc. which you can choose as per your needs.

Mutual Funds are financial instruments. These funds are collective investments which gather money from different investors to invest in stocks, short-term money market financial instruments, bonds and other securities and distribute the proceeds as dividends. The Mutual Funds in India are handled by Fund Managers, also referred as the portfolio managers. The Securities Exchange Board of India regulates the Mutual Funds in India. The unit value of the Mutual Funds in India is known as net asset value per share (NAV). The NAV is calculated on the total amount of the Mutual Funds in India, by dividing it with the number of units issued and outstanding units on daily basis.

A mutual fund company collects money from several investors, and invests it in various options like stocks, bonds, etc. This fund is managed by professionals who understand the market well, and try to accomplish growth by making strategic investments. Investors get units of the mutual fund according to the amount they have invested. The Asset Management Company is responsible for managing the investments for the various schemes operated by the mutual fund. It also undertakes activities such like advisory services, financial consulting, customer services, accounting, marketing and sales functions for the schemes of the mutual fund.

A lot of people take a chance and speculate, some get lucky, most don't.This is where mutual funds come in. Mutual funds offer you the following advantages.

Mutual Funds help investors generate better inflation-adjusted returns, without spending a lot of time and energy on it. While most people consider letting their savings 'grow' in a bank, they don't consider that inflation may be nibbling away its value. Mutual Funds provide an ideal investment option to place your savings for a long-term inflation adjusted growth, so that the purchasing power of your hard earned money does not plummet over the years. consider that inflation may be nibbling away its value. Mutual Funds provide an ideal investment option to place your savings for a long-term inflation adjusted growth, so that the purchasing power of your hard earned money does not plummet over the years.

Every Mutual Fund scheme has a well-defined objective and behind every scheme, there is a dedicated team of financial experts working in tandem with specialized investment research team. These experts diligently and judiciously study companies, their products and performance, and after thorough analysis, they decide on the best investment option most aptly suited to achieve the scheme's objective as well as investor's financial goals.

Mutual funds are an ideal investment option when you are looking at convenience and timesaving opportunity. With low investment amount alternatives, the ability to buy or sell them on any business day and a multitude of choices based on an individual's goal and investment need, investors are free to pursue their course of life while their investments earn for them.

Mutual Funds generally provide an opportunity to invest with fewer funds as compared to other avenues in the capital market. You can invest in a mutual fund with as little as Rs. 5,000 and also have the option of investing a little of Rs.500 every month in a SIP or Systematic Investment Plan

It plays a very big part in the success of any portfolio. Mutual funds invest in a broad range of securities. This limits investment risk by reducing the effect of a possible decline in the value of any one security. Mutual fund unit-holders can benefit from diversification techniques usually available only to investors wealthy enough to buy significant positions in a wide variety of securities.

You can encash your money from a mutual fund on immediate basis when compared with other forms of savings like the public provident fund or National Savings Scheme. You can withdraw or redeem money at the Net Asset Value related prices in the open-end schemes. In closed-end schemes, lock in period is mentioned, investor cannot redeem his investment until that period.

Based on medium or long-term investment, mutual funds have the potential to generate a higher return, as you can invest on a diverse range of sectors and industries.

The performance of a mutual fund is reviewed by various publications and rating agencies, making it easy for investors to compare fund to another. As a unitholder, you are provided with regular updates, for example daily NAVs, as well as information on the fund's holdings and the fund manager's strategy.

Mutual funds invest in different securities like stocks or fixed income securities, depending upon the fund's objectives. As a result, different schemes have different risks depending on the underlying portfolio. The value of an investment may decline over a period of time because of economic alterations or other events that affect the overall market. Also, the government may come up with new regulations, which may affect a particular industry or class of industries. All these factors influence the performance of Mutual Funds.

The diversification that mutual funds provide can help ease risk by offsetting losses from some securities with gains in other securities. On the other hand, this could limit the upside potential that is provided by holding a single security.

Investors cannot determine the exact composition of a fund's portfolio at any given time, nor can they directly influence which securities the fund manager buys.

NAV is the sum total of all the assets of the mutual fund (at market price) less the liabilities (fund manager fees, audit fees, registration fees among others); divide this by the number of units and you get the NAV per unit of the mutual fund.

What Does Compound Annual Growth Rate - CAGR Mean?

The year-over-year growth rate of an investment over a specified period of time. The compound annual growth rate is calculated by taking the nth root of the total percentage growth rate, where n is the number of years in the period being considered.

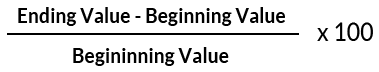

These are the simple returns, i.e. the returns that an asset achieves, from the day of its purchase to the day of its sale, regardless of how much time has elapsed in between. This measure looks at the appreciation or depreciation that an asset - usually a stock or a mutual fund - achieves over the given period of time. Mathematically it is calculated as under:

Generally returns for a period less than 1 year are expressed in an absolute form.

AllWin Financial Services

Flat No. 9, Sai Sadan,

43/4, Prabhat Road, Income Tax Lane,

Opp. Seed Infotech, Off Karve Road,

Pune-411004.

Email Id:custcare@allwinfinance.com

Mobile: +91 9158 348 484